ADA Price Prediction: Technical and Fundamental Analysis Points to $1 Target

#ADA

- ADA trading above 20-day MA indicates underlying bullish momentum

- Market sentiment strongly positive with multiple $1+ price targets

- Key resistance at $0.9252 with support firmly established at $0.86

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Above Key Moving Average

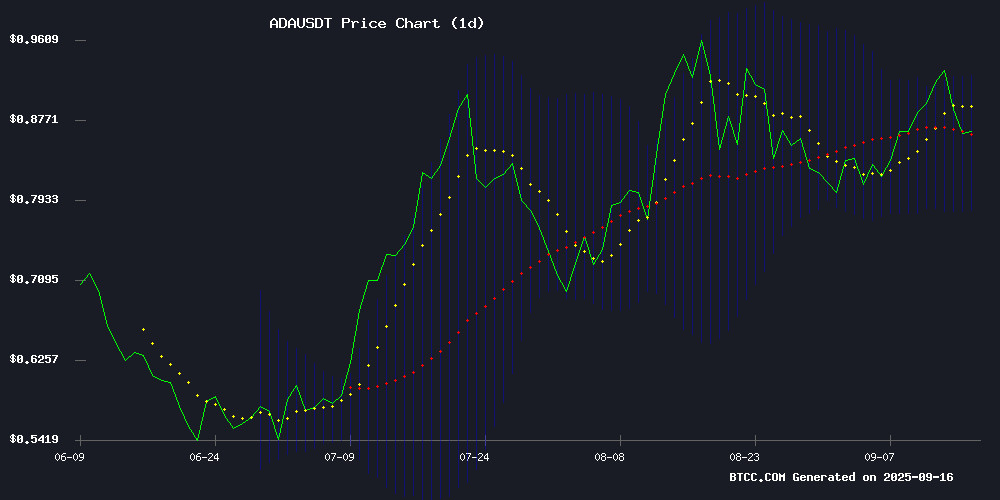

ADA is currently trading at $0.8812, positioned above its 20-day moving average of $0.8536, indicating underlying strength. The MACD configuration shows a bearish crossover with the signal line above the MACD line, though the histogram suggests weakening downward momentum. Bollinger Bands reveal ADA trading in the upper portion of the range, with immediate resistance at $0.9252 and support at $0.7820. According to BTCC financial analyst Olivia, 'The price holding above the 20-day MA while approaching the upper Bollinger Band suggests consolidation with potential for upward breakout if momentum sustains.'

Market Sentiment: Bullish Outlook Dominates ADA Price Projections

Current market sentiment surrounding ADA is overwhelmingly bullish, with multiple analysts projecting targets between $1.00 and $1.50 in the NEAR term. The convergence of technical upgrades, particularly the LEIOS implementation, combined with broader market catalysts like Federal Reserve decisions, creates a favorable environment for price appreciation. BTCC financial analyst Olivia notes, 'The $0.86 support level has held remarkably well amid market volatility, providing a solid foundation for the projected move toward $1.00. October 2025 appears to be a critical timeframe for these projections to materialize.'

Factors Influencing ADA's Price

Cardano Price Prediction: Indicators Point to Momentum Shift as $1 Target Comes Into View

Cardano has stabilized near the $0.86 support level, sparking cautious optimism among traders. A fresh TD Sequential buy signal suggests selling pressure may be easing, with analysts eyeing a potential rebound toward $0.88-$0.90 resistance.

The cryptocurrency's recent 4.34% decline contrasts with emerging technical strength. Analyst Ali Martinez notes the TD Sequential accurately predicted ADA's last local top, adding credibility to the current reversal signal. Market participants now watch for confirmation of sustained upward momentum.

Cardano Price Eyes $1 as Key Resistance Nears

Cardano (ADA) shows bullish momentum, trading at $0.8553 with higher lows since mid-2023. A weekly close above $0.90 could pave the way to $1, while $0.80–$0.83 acts as critical support.

Technical indicators favor buyers, with ADA trading above the 20-week Bollinger Band basis and Ichimoku cloud. The widening Bollinger Bands suggest a potential breakout, contingent on holding current levels.

Failure to maintain $0.80 may shift focus to $0.77, but the market structure remains constructive for 2025 gains.

Cardano Price Poised for Major Volatility Ahead of Fed Decision, Analyst Eyes $1.50 ADA Rally

Cardano's ADA token shows signs of impending volatility as the Federal Reserve's rate cut decision looms. Analyst Dan Gambardello identifies a bullish consolidation pattern mirroring previous cycles, suggesting potential for a breakout toward $1.50. The weekly chart reveals months of sideways movement beneath the 20-week moving average, with RSI and MACD indicators hinting at accumulating upward pressure.

Despite current resistance at the $1 level, the token's technical structure appears primed for movement. Gambardello notes frustratingly familiar price action—similar to historical patterns preceding major rallies. Market participants await the Fed's decision as a likely catalyst for ADA's next significant move.

Cardano Price Outlook: ADA Targets $1.30 With Bullish Technical Signals

Cardano (ADA) demonstrates resilience in a choppy market, edging closer to a critical resistance level at $1.30. The token gained 1.61% in the past 24 hours despite a 24.81% drop in trading volume, maintaining a $31.11 billion market cap.

Network adoption reaches a pivotal milestone with 3.125 million holders, signaling growing institutional confidence. Analysts highlight this fundamental strength as a potential catalyst for the next upward leg.

Technical charts reveal a consolidation pattern breaking toward bullish territory. Steady weekly green candles suggest accumulating momentum, with traders watching for a decisive breakout above key resistance levels.

Cardano (ADA) Holds $0.86 Support Amid Market Cap Surge and LEIOS Upgrade Momentum

Cardano's ADA demonstrates resilience at $0.86 despite a slight 24-hour dip of 0.28%, with technical indicators painting a mixed picture. The Relative Strength Index sits neutrally at 50.64, while the MACD histogram flashes bullish signals. This comes as ADA unseats TRON to claim the ninth-largest cryptocurrency by market capitalization—a positional shift reflecting growing institutional confidence in Cardano's ecosystem.

The blockchain's 24/7 "Follow the Sun" development initiative for its LEIOS upgrade marks a strategic escalation in protocol scalability efforts. Such technical advancements coincide with broader institutional adoption trends, including Binance and Franklin Templeton's tokenization ventures. While these developments haven't yet catalyzed significant price movement, they underscore Cardano's positioning within the maturing blockchain infrastructure landscape.

Cardano Price Analysis: Key Levels to Watch in Coming Days

Cardano's ADA shows tentative recovery signs after dipping to $0.85, now consolidating between $0.87-$0.90. Trading volume remains subdued, reflecting market caution rather than strong conviction.

The token faces immediate resistance near $0.95, with traders questioning whether it can challenge the psychological $1.00 barrier this month. A breakout could potentially target $1.10-$1.20, though current technical indicators show mixed signals.

MACD turns bearish while RSI maintains upper band positioning, creating tension between opposing technical narratives. The rising wedge pattern suggests an impending volatility spike, with ADA's ability to hold current support levels being crucial for near-term direction.

ADA Price Prediction: Cardano Eyes $0.95-$1.05 Target by October 2025

Cardano (ADA) is poised for a potential 28% surge to $1.05 in the coming weeks, with technical indicators signaling a bullish breakout. The cryptocurrency currently trades within a rising channel, finding robust support above the $0.90 level.

Analyst consensus reveals institutional alignment on ADA's technical setup, with CoinCodex projecting the most aggressive target at $1.05 by October 2, 2025. CoinDCX echoes this optimism, forecasting a $0.98-$1.12 range post-breakout. Even conservative estimates like Changelly's $0.882 prediction appear outdated against current momentum.

The $0.90-$0.95 zone emerges as critical resistance. A decisive breach could validate the rising channel pattern observed since July, potentially unlocking the upper target range of $0.95-$1.05.

Will ADA Price Hit 1?

Based on current technical indicators and market sentiment, ADA has a strong probability of reaching $1.00 in the coming weeks. The price is already trading 3.2% above its 20-day moving average, and with bullish momentum building around key resistance levels, the path to $1.00 appears achievable. However, traders should monitor the Federal Reserve's upcoming decision, which could introduce volatility.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $0.8812 | Bullish (above MA) |

| 20-Day MA | $0.8536 | Support Level |

| Upper Bollinger | $0.9252 | Near-term Resistance |

| MACD Histogram | -0.023115 | Weakening Bearish Momentum |